Calibre’s view on the future of the provision of Health & Wellness services to Organisations and their Employees

Part 1 – Problems Facing the Healthcare Market

Healthcare Market Overview

“The company cannot afford to offer medical aid to all the employees, it’s just too expensive” or “I am going to downgrade to a lower option or change to a hospital plan only”. These have become the common responses from organisations and their employees when asked about their medical cover. Then, of course, there is an overwhelming majority of blue-collar workers with no medical cover at all.

The truth is premiums are increasing on average by 9% – 15% per annum and where medical schemes or particular plans have had the lower increases these are being subsidised by scheme reserves, which is not sustainable in the long-term and will result in above-average increases in the future to catch-up.

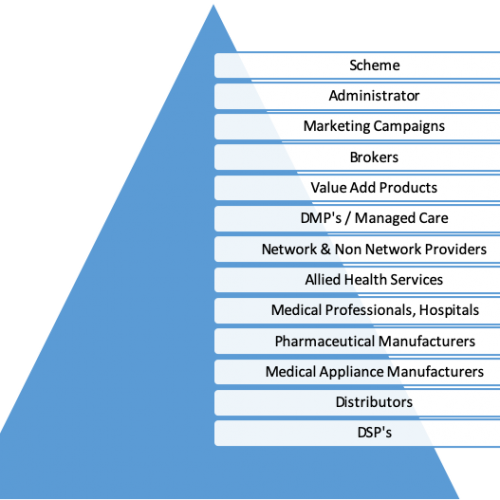

It is unfortunate that medical schemes are not able actually to control the cost increases and the actual cost of medical services provided to their members. There are many reasons for this cost increase and it can be associated with medical schemes having to pay for Prescribed Minimum Benefits (PMB’s), over-servicing by providers, profiteering by manufactures and ineffective Designated Service Providers (DSP’s). After all, every link in the healthcare delivery chain is a for-profit entity. The list of players is almost endless and each of the players listed in the Table 1. below have their own profit making needs, including their own range of service providers who also need to make profit and cover costs ranging from general operational costs to marketing and financing of expansion. All this costs and are funded either exclusively or largely by the members’ contribution. Just consider the following;

- Scheme Administration

- Administrators are needing to achieve scale to be able to keep non healthcare costs within inflationary increases

- Scheme Membership Growth

- Expensive Marketing Campaigns to attract new lives as well as influencing Broker activity

- Brokers are paid a commission per principal beneficiary, however, there are other costs associated with Brokers including retention and training

- Service Providers

- Disease Management Programmes

- General Practitioners

- Specialists

- Allied Health Services

- Hospitals

- Pharmaceutical Manufacturers

- Medical Appliances

- Distributors

- Non-Healthcare providers

It is then hardly surprising that members’ contributions are rapidly increasing as schemes appoint even more third party providers in an effort to “manage the costs”. The net effect is that the schemes have a DMP in place to police the healthcare professional and the police have not been successful or effective and so now we have police to police the police. The conclusion to this is that the administrators are not very successful in managing overall cost increases.

We are therefore seeing an accelerating trend where “Low-Cost Benefit Option” (LCBO’s) and “Hospital Plans” (HP’s) are becoming ever more popular as a buy down for older members, from options that are more comprehensive, or the option of choice for blue-collar workers. Many young and healthy are opting for traditional Hospital Plans. Thus, the unfortunate consequence of LCBO’s is an ever-increasing question regarding their financial viability. These losses are largely due to, not only what is discussed in relation to table 1, but also providers may default to using ICD coding in line with PMB’s so that their patients can be treated and to ensure reimbursement. Further influencing the financials are members being admitted to hospital when the out of hospital benefits become depleted. Notably, blue-collar members are making more and more use of provincial hospitals, as they are more likely to be located near their homes. Given this fact and that the provincial hospitals’ administration and claims capabilities have improved the cost of this line item is ever-growing.

The member experience in certain LCBO’s has increasingly become problematic with fewer Network Providers (NP’s) to choose from forcing them to buy up into higher options or increasing their out-of-pocket spend. Often the member has to travel a longer distance to get an NP’s leading to more time away from work to be attended too with cost implications for both employee and employer.

The contributions range from R1,200.00 – R1,900.00 per principal member and the average for a family (M+2) ranges from R2,700.00 – R4,200.00 and in some instances premiums are income-based, where others are not. Important to note is that these plans have strict Non-PMB limits and Non-Network services require co-payments or are not covered at all. Furthermore, for all plans pay at 100% of scheme rates, which unless rates are pre-negotiated by the scheme or the member there will be significant out-of-pocket expenses. The overall annual limits range from around R1,000,000.00 to unlimited with sub-limits

“Primary Care Products” (PCP’s) are products provided for through insurance vehicles as an alternative to traditional medical aid to provide for healthcare expenses. However, there remain legislative issues to be dealt with in the near future and which might have a severe negative implication for these products. However, PCPs allow the member the ability to select a product that covers a varying combination of in-hospital expenses with certain levels of day-to-day expenses this allows the individual greater purchasing flexibility within their level of affordability.

However, this flexibility comes with various implications such as stricter individual health underwriting and thus it can become more expensive than traditional LCBO’s with possibly lesser health coverage, with a very strict network provider arrangement.

One might assume that when an individual decides to purchase medical cover that they intend to purchase such care in the private sector to avoid congested and poorly run State Facilities. In fact, what is evident from the majority of these PCP’s is that Hospitalisation is covered in a State Hospital either explicitly or because of the benefit value. Given that the average cost of hospitalisation in the private sector is R 8,000.00 per day for approximately 4 days, the cost is estimated on average to be R32,000.00 in a private hospital. If one considers the PCP’s it generally offers between R8,500 for the first day, R5,500 for the second day, R5,000 for the third and R4,000.00 per day thereafter. Therefore if covered in private hospitals under similar circumstances it would only cover R23,000.00 of the medical bill leaving the member out of pocket. In addition, private hospitals are aware of such shortfalls and require guarantees and/or cash upfront with admission, with waiting periods of up to 24 months applicable. A further indication that these products are aimed at utilisation of State facilities is the accident and injury benefit, which generally is limited to R100,000.00 and a private hospital, will request a minimum of R250,000.00 upfront or as a guarantee. Therefore, members will still have to use State facilities. The day-to-day cover offered varies from only acute to acute and chronic cover. The acute cover appears to be linked to the number of available consultations, and such consultations are limited to 3 or 4 per annum for the lower products and 5 to 6 on the more expensive products, with 1 specialist visit to the maximum value of R900.00. Waiting periods of up to 6 months are applicable. The price range of these products are from R185.00 per principal member per month to R800.00 per principal member and for a family (M+2) R445.00 to R1,900 per month for the top options, of course, this is without any risk rating having been applied.

“Traditional Hospital Plans” (THP’s) offered by medical schemes have become popular with the young and healthy as well as those people who are generally able and willing to self-fund their day-to-day medical expenses. Of course, there are those individuals or families who only have a hospital plan for purely financial affordability reasons and in such instances may, in fact, pose a threat to the medical scheme when their acute or chronic day-to-day care goes untreated resulting in hospital stays with complications. These plans generally have a limit of 100% – 200% of scheme rates thus; there may be a substantial shortfall that the member has to settle. These plans do offer cover for chronic conditions and some limited other out of hospital cover. The cost of such plans ranges from R850.00 to R4,655.00 for and individual and for a Family (M+1) from R1,900.00 to R10,000.00.